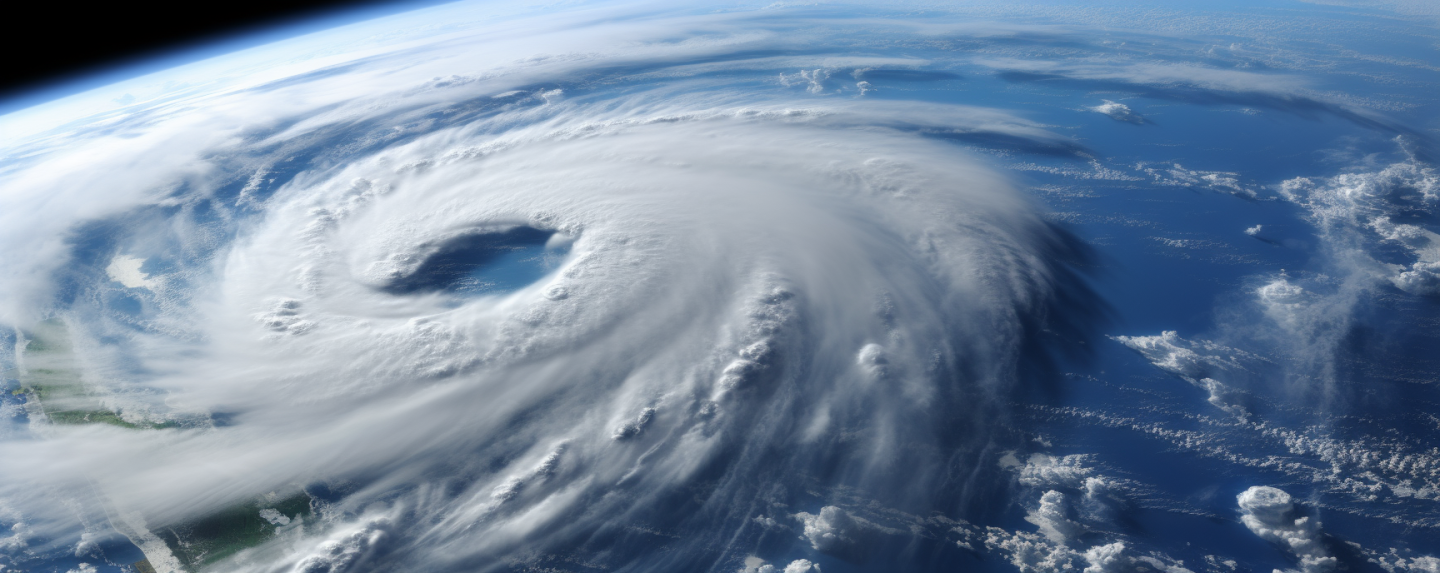

Insurance-Storm Claims

Understanding Insurance Claims

Our practice focuses on Texas insurance matters, primarily coverage, extracontractual, premium litigation, and on related appeals. Also, our attorneys will advise insurance clients on coverage and extracontractual issues. This includes the handling of administrative hearings, appeals, and defending class actions. Premium overcharge and coverage issues are areas we specialize in as well.

Statistics

Trust A Firm With Over 10 Years Of Experience In Fighting For Others

01

How much does it cost to hire you?

When you choose our firm, there are no upfront costs to worry about. Our fee structure is contingent upon the successful resolution of your case, meaning you only pay when we achieve a favorable outcome on your behalf. Furthermore, we handle all the initial expenses related to the preparation and handling of your case, ensuring that you will never receive an invoice or be billed for these upfront costs. This approach allows our valued clients to access top-notch legal representation, supported by our unwavering dedication to providing exceptional service.

02

How can I determine if I have a viable case?

In the current landscape, insurance companies are increasingly utilizing tactics such as delaying, underpaying, and denying claims, with their focus often directed towards pleasing stockholders and board members. If you suspect that you have been impacted by these practices, we urge you to promptly contact our office. We provide a free consultation to evaluate your circumstances and offer guidance on the most suitable steps to take.

03

What is bad faith and how does it affect my claim?

If you have experienced delays, inadequate payments, or outright denials of your insurance claim without valid justification, inspection, or prior notice, you may have legitimate grounds to pursue a bad faith claim against your insurance provider. In accordance with state laws, you may be entitled to seek damages up to three times the amount of losses incurred. To explore your options and safeguard your rights, we invite you to schedule a complimentary consultation with our office.

04

What sets flood damage apart from wind damage?

Windstorm damage refers to the destruction of property caused by strong winds generated by hurricanes, tornadoes, and storms. This kind of damage often includes water-related issues, such as rain seeping into homes or businesses due to roof or window damage caused by high-speed winds. On the other hand, flood damage involves water-related damage resulting from rising waters or storm surges. It is important to note that standard homeowners and business insurance policies usually do not provide coverage for flood damage.

JJJ: Insurance Claims Case Updates